By: Michael K. Warne, AAMS®

After a very steady run, the global markets have had a bit of a stumble lately, and I thought I’d briefly share some of my thoughts with you. As always, if I can add color in a 2-way conversation with you, that’s in part why we’re here, so please don’t hesitate to call me.

First off, I’ll say this: We’re on top of what’s going on, and volatile markets should not surprise any of us. As we’ve discussed in our risk conversations, some volatility is the price of admission for long-term returns that exceed those of cash and CDs. If you’re curious about current events, I invite you to continue reading this brief note. If you’d like to carry on this evening living your One Best Life, knowing we’ve got this covered, then there’s absolutely no need to read any further.

OK, so you’ve continued on– here we go:

Since the early 1990’s, Japan has struggled to grow their economy, and their interest rates were kept extremely low. If you remember our meetings a few years ago, we all marveled at how they could have negative interest rates in Japan. Many sophisticated, ultra-aggressive investors took advantage of these low rates and borrowed money from Japanese banks in Japanese Yen. They then converted the Yen into US Dollars and invested in risk assets. This strategy, known as the “Yen Carry Trade,” has grown to an estimated size of $4 trillion.

On July 31st, less than a week ago, the Bank of Japan (their “Federal Reserve”) raised their interest rates by a mere 0.25%, the first raise in over 17 years. As a result, the Yen increased in value versus the US Dollar, adding fuel the Yen’s recent strength versus the US Dollar that started on July 3rd. This not only made interest costs on those variable rate loans slightly more expensive, but a strengthening Yen also makes it more expensive to pay back those loans with US Dollars.

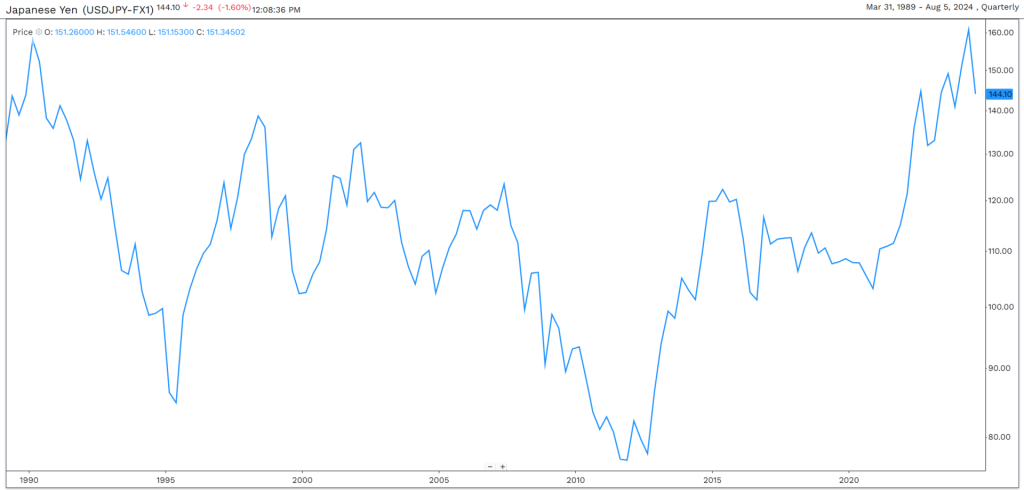

For most investors who may have borrowed in Yen, this isn’t a big deal. But for many whose “loan-to-value ratio” was already super high, they had to liquidate their positions—hence Friday’s and today’s market action. In essence, these borrowers went over their credit limit and had to sell some assets to (to pay down their debt in Yen) to get back under the limit. This unwinding of positions can lead to sharp moves in currency markets, as we saw in October 1998 when a similar situation led to a 25-Yen correction in US Dollar vs. Yen in a short period. If you’ve traveled abroad, you know how volatile the currency markets are. But if you zoom out, you’ll see that the Japanese Yen versus the US Dollar has been locked in the same broad range since 1987. This recent move has been swift, but it’s barely noticeable on the long-term chart.

What are we doing about this? Well, we’ve already done it. We’ve carefully allocated every one of our clients to be ready for times like this. Most of of our clients participated in our Spring Reviews, and together we went through the important process of determining your Risk Number. Whether you’re an aggressive investor or a conservative one, your investments are responding exactly as they should be and exactly like we discussed.

We continue to stay on top of this unwinding of the Yen Carry Trade. As conditions warrant, we’ll make adjustments to portfolios. But for now, we weather the storm knowing that our ship was well-prepared for seas like this.

I’m available anytime you need me. For now, borrowing from the Brits, we’ll keep calm and carry the trade.